Getting started in stock market investing may seem daunting at first. However, it is easier than ever to invest in the stock market nowadays with the myriad of tools available. And you don’t need a truckload of money to begin! There’s no need for complex strategies; this article breaks down key ideas, ensuring that whether you’re a beginner or seasoned investor, growing wealth in the stock market is within reach. Join us in this introduction to stock market investing, where everyone, regardless of expertise, can learn, understand and implement the strategies needed to invest in the stock market successfully.

Key takeaways

- Understanding the stock market: The stock market is a marketplace where people buy and sell shares, representing ownership in businesses. It may seem complex, but with research, anyone can learn how to invest.

- What shares represent: Shares are units of a company’s value. Owning shares means holding a portion of the company, which can increase or decrease in value based on the market.

- Trading shares: Shares are bought and sold through brokers, often via online platforms. Successful trades depend on matching buyers and sellers at agreed-upon prices.

- Why invest in the stock market?: Investing in the stock market is a common strategy for growing wealth, with potential long-term returns averaging around 9% to 10% annually in major markets like the US and Australia.

- Stock investing vs. stock trading: Investing involves holding stocks long-term to grow wealth, while trading is short-term, aiming for quick profits from price fluctuations.

- Passive investing strategies: Passive investing includes buying diversified funds like ETFs, LICs, or REITs, which require less active management and offer broad market exposure.

- Active investing strategies: Active investing involves hands-on research and selecting individual stocks based on value, growth potential, or dividend payouts.

- Combining strategies: The “core-satellite” approach combines passive and active strategies, offering diversification and the potential for higher returns.

What is the stock market?

The stock market is a place where people buy and sell shares of companies. Imagine it like a big marketplace, but instead of fruits or clothes, people are trading pieces of ownership in businesses.

The stock market can seem confusing or complicated to beginners. There are many different styles and strategies of trading and investing, with advantages and disadvantages in each strategy. When broken down, and with a little research, the stock market can be understood by anyone.

This article provides an introduction to stock market investing by breaking down some of the key concepts in an easy-to-understand manner. Importantly, you don’t need to be a math genius or professional stock trader to grow wealth from the stock market! The concepts outlined below and in related posts can be used by anyone willing to dabble in the stock market.

Disclaimer: The information outlined in this article covers the basics of stock market investing and is general in nature. It should not be taken as specific financial advice. Please read our financial disclaimer for more information.

What are shares?

Shares can be thought of as small units of a company that represents a fraction of the value of the company. For example, a company that is worth $10 million might have 1 million shares on offer. The share price for this company will be $10. In other words, there are 1 million shares available valued at $10 each, totaling $10 million.

If you bought 1000 shares, you would need to pay 1000 x $10 per share, or $10,000, plus a small brokerage fee. In effect, you now own 1000 shares out of the 1 million available. This would be equivalent to owning approximately 0.1% of the company.

Where are shares bought and sold (traded)?

Shares are bought and sold at a stock market through a broker. Before the internet became a mature technology, brokers were usually individuals who would receive a trade (buy or sell) request, match buyers and sellers, and then execute the trade.

Brokers are now more commonly internet-based, with many companies offering brokerage services. These include major banks and dedicated brokerage companies, which offer online and mobile device applications that make trading very quick and simple.

For a buyer to be able to purchase shares at a particular price, two conditions must be met. Firstly, there needs to be a seller, or multiple sellers, willing to sell their shares at that price. Secondly, there must be enough shares available at or below that price for sale.

If other buyers are also trying to buy shares at that price, the number of shares available at that price may not be enough for a successful trade. This is a supply/demand scenario and is one reason why share prices fluctuate.

Most countries have a stock exchange, which is a government-controlled centralized location where companies and securities are listed.

Investors buy and sell securities such as stocks, options, and bonds through the stock exchange. Some examples of exchanges around the world include:

- New York Stock Exchange (NYSE) and National Association of Securities Dealers Automated Quotations (Nasdaq) in the United States

- Euronext covering several European countries

- Toronto Stock Exchange (TSX) in Canada

- London Stock Exchange (LSE) in the United Kingdom

- Shanghai Stock Exchange and Shenzen Stock Exchange in China

- Australian Securities Exchange (ASX) in Australia

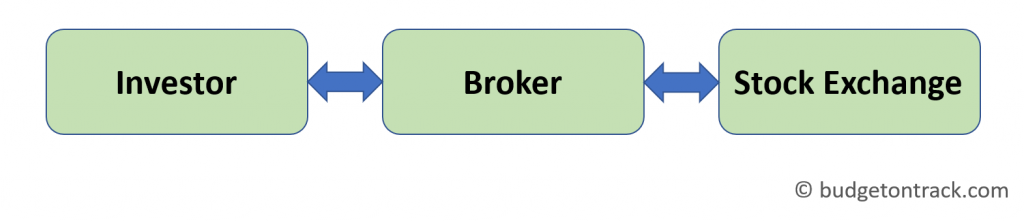

The relationship between an investor, a broker, and the stock exchange is illustrated below.

The investor communicates through a broker, which can be an individual or through an online brokerage service, to request a buy or sell order.

The broker then matches up buyers and sellers for the security and executes the trade through the stock exchange. The broker then notifies the investor when the trade has been executed.

Why invest in the stock market, and what returns can you expect?

Stock market investing is one of the most common investing strategies. Approximately 61% of adults in the United States owned stocks, including retirement funds, in May 2023.[1]

Approximately one-half of all Australian adults hold investments outside their superannuation and primary dwelling as of 2023. Of those, approximately three-quarters own shares, and half are between the ages of 25 to 49 years old – the “wealth accumulators”.[2]

The stock market is an easy way for beginners to start their investment journey. With many online brokerage options, you can begin investing with as little as a few hundred dollars, or even less for some investing apps.

The stock market can help investors grow wealth over the long term. For example, the US stock market S&P 500 has returned on average about 9% to 10% per year since its inception.[3]

Adjusted for inflation, the real return averaged 6.8% per year from 1971 to 2020 (a 50-year timeframe) and 8.3% per year from 1991 to 2020 (a 30-year timeframe).[4]

Likewise, the Australian stock market has returned on average about 9.8% per year over the 30-year timeframe from 1992 to 2022.[5]

Note: The stock market statistics stated above are averages over medium to long-term time periods (between 10 and 50 years). The stock market has yielded below average or even negative returns in some years, and higher than average returns in other years. In addition, past performance does not imply future performance. We strongly recommend seeking financial advice from a qualified professional or conducting adequate research before investing in the stock market.

Let’s now cover the basic difference between stock investing and stock trading. Then we’ll discuss the most common strategies people use to build their stock market investment portfolios.

The strategies covered below focus on personal investment accounts and do not include funds such as a 401(k), Roth 401(k), Roth IRA, ISA, superannuation, or other retirement-based funds.

Stock investing versus stock trading – what’s the difference?

Investing and trading differ in the way share portfolios are managed and the timeframe used between buying stocks and selling them.

Investing generally involves buying stocks and holding them for at least 1 year, and often several years to decades.

The aim of investing is to grow wealth by allowing the stocks to increase in value over the long term. This is a buy-and-hold strategy.

With enough diversification, investment returns can be close to the general long-term market returns of 8 to 10%.

Trading is a shorter-term strategy, ranging from single days (day trading) to between a few days to a few weeks (swing trading), and sometimes up to several months (e.g. general trading and short selling).

The most common aim of trading is to buy stocks at a lower price and sell at a higher price within a relatively short time frame to lock in profits.

A trader hopes to gain higher profits than the general market with returns above the long-term average of 8% to 10% per year. Traders rely on the volatility of the share price of companies to achieve these goals.

Short-selling is a less common form of share trading. This type of trading is made by people who believe a stock is overvalued and expected to drop in price. It is a more risky strategy and is generally only used by experienced traders and investors.

Short selling involves borrowing a stock at the current price and selling it to a buyer. The seller then aims to buy the stock back at a lower price in the future to lock in profits.

The primary risk with short selling is that a stock may increase in price by a significant amount instead of decreasing. This can force the investor to purchase the shares at an even higher price.

The remainder of this article focuses on investing and covers different strategies investors use to build their share portfolios.

Passive stock market investing: the set and forget approach

There are two broad categories of stock market investing strategies: passive and active.

Passive investing involves investing in a basket of shares aimed at diversification. Some diversify across a range of companies within a market and others within particular sectors or asset classes within a market.

Rather than buying many individual shares and incurring brokerage fees for each, you can buy and sell a group of stocks under a single stock code. This reduces brokerage fees and greatly simplifies the process of owning shares in many companies.

Exchange Traded Funds

The most common type of diversified passive stocks are exchange-traded funds (ETFs). ETFs became popular in the mid-1990s. They started to gain traction in the early 2000s with the introduction of more diversified funds from companies such as Blackrock and Vanguard.

There are many companies around the world that issue ETFs, each offering different fund types. Some of the biggest ETF issuers in the US, based on assets under management (AUM), include Blackrock, Vanguard, and State Street.

These three issuers combined manage approximately US$5 trillion of AUM in US-listed ETFs as of July 2023.[6]

Listed Investment Companies

Another type of diversified investment fund is a listed investment company (LIC). LICs are companies that invest in other companies based on various strategies.

Listed investment companies are similar to ETFs in that they can be traded on the share market as a single stock code. However, they differ in that they are actively managed, whereas ETFs can be passively or actively managed.

Actively managed funds generally incur higher fees compared with passively managed funds. Because of this, it is important to research the fees associated with any fund you are considering adding to your investment portfolio.

One of the most well-known listed investment companies in the US is Berkshire Hathaway. This is a multinational conglomerate holding company managed by its CEO, Warren Buffet, who is accredited as being one of the top ten investors of all time.[7]

Real Estate Investment Trusts

Real Estate Investment Trusts, or REITs, are companies that own, operate, or finance income-generating real estate.[8]

Some examples of income-generating real estate include commercial properties such as offices, medical facilities, and shopping complexes. They can also include hotels and warehouses.

One of the main advantages of REITs is that they provide investors with a steady income by sharing the majority of profits as distributions. Another benefit of owning REITs is they require less capital to invest compared with physical property.

This allows investors to own a diversified property portfolio without having to actively manage the properties. However, they generally do not increase in value at the same rate as other equities.

Active stock market investing: the hands-on approach

Active investing involves researching individual companies to determine whether they are worth investing in.

It is a much more hands-on approach than passive investing. Active investing requires more time and effort to ensure that the company is a worthwhile investment.

Active investing can be broken down into value investing, growth investing, and dividend investing. We’ll briefly cover each of them here.

Value investing

Value investing is an investing strategy where investors aim to identify companies that are considered to be trading at a significantly lower value than what they think their current worth is.

The aim is to buy the stock at a low price (a good value), with the expectation that the stock price will increase faster than the overall market, thereby providing a better return.

Growth investing

Growth investing is an investing strategy where investors buy stocks that they believe will grow in value and outperform the overall market.

Investors who buy growth stocks expect the companies will have future potential for sustainable growth. This may be because of a new product line, a competitive advantage over similar companies, superior management, or other factors that can give the company an edge over others.

Dividend investing

Dividends are payments made from a company to its investors. Dividends are usually paid at regular intervals (commonly every 3 or 6 months, and sometimes monthly).

Companies that pay dividends often give the stock owner the option to automatically reinvest the dividends. This is termed a dividend reinvestment plan or DRP, sometimes abbreviated DRIP.

Reinvesting the dividends increases the quantity of shares owned and consequently, the total value of the stock owned by the investor.

When setting up a DRIP, you can fully participate, where 100% of the dividend payout is added to the fund as more shares. Alternatively, you can choose a percentage of the distribution to be put back into the fund as shares, with the remainder paid into your brokerage account as cash.

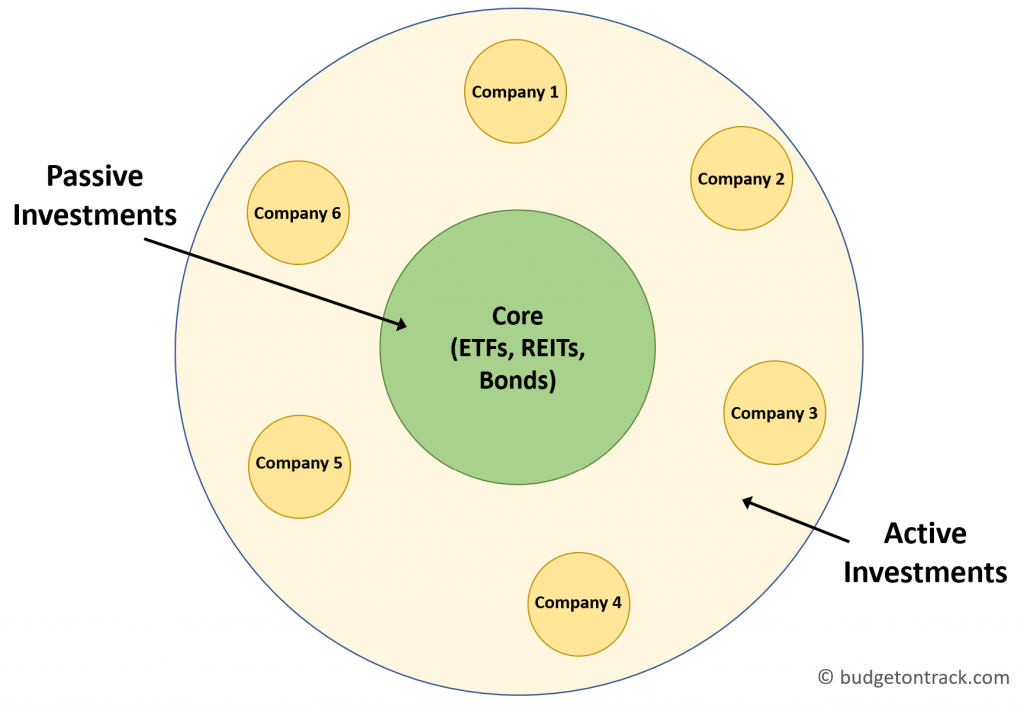

Passive plus active investing – the ‘core-satellite’ strategy

Even though there are several different strategies for investing in securities described above, most investors choose to use more than one of these strategies.

One common example is where investors passively invest in securities such as ETFs, Real Estate Investment Trusts (REITs), and bonds as their main “core” strategy.

They also actively research and invest in companies with the aim of growing their total investment portfolio at a faster rate than the overall market.

This strategy can be visualized by comparing it to a planet with several moons, as shown below.

The “planet” represents the core, passive investments comprising lower-risk investments such as ETFs, and the “moons” represent potentially more risky, active investments comprising individual companies.

The advantage of this strategy is diversification across the broader markets as well as more granular diversification within companies and market sectors.

Diversification provides better insurance against losing value in a portfolio during market or sector downturns. It effectively buffers and reduces significant fluctuations in portfolio value.

FAQs

1. What is the stock market?

The stock market is a place where people buy and sell shares, which are small units of ownership in companies. It’s like a marketplace for trading business ownership stakes.

2. What are shares?

Shares represent a fraction of a company’s value. When you buy shares, you own a part of that company, and the value of your shares can rise or fall based on the company’s performance and market conditions.

3. How do I buy and sell shares?

You can buy and sell shares through a broker, which can be an individual or an online brokerage service. The broker facilitates trades by matching buyers and sellers on the stock exchange.

4. Why should I invest in the stock market?

Investing in the stock market is a popular way to grow wealth over time. Historically, stock markets have provided average annual returns of around 9% to 10% in major markets like the US and Australia.

5. What is the difference between stock investing and stock trading?

Stock investing involves buying shares and holding them long-term to build wealth, while stock trading focuses on short-term buying and selling to make quick profits.

6. What are Exchange-Traded Funds (ETFs)?

ETFs are funds that hold a diversified portfolio of stocks and are traded on the stock exchange like individual shares. They offer a way to invest in multiple companies with a single purchase, reducing risk through diversification.

7. What is the ‘core-satellite’ investment strategy?

The ‘core-satellite’ strategy combines passive investing, like ETFs, for the core of your portfolio, with active investing in individual stocks or sectors to potentially enhance returns.

Image attribution: Pixabay (stock chart), Pexels (New York Stock Exchange)